Most people reading this post want new codecs to succeed as soon as possible, and I do as well. But whenever I think about codec adoption, six pictures come to mind.

Contents

Overview

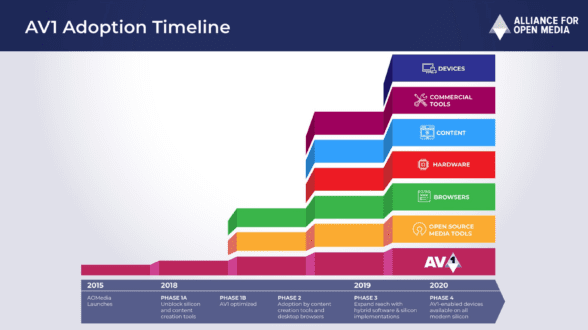

The first was the foundational adoption timeline released by the Alliance for Open Media (AOMedia) with the launch of AV1 in April 2018 (see above). Essentially, this posited a two-year adoption timeline with the cadence: one year for silicon and two years for consumer devices. Unfortunately for AV1, silicon production slipped (like it did for many technologies during the COVID/supply chain woes), and AV1 substantially missed the mark.

The AOMedia timeline also ignores the reality that independent publishers won’t adopt a codec until it achieves a market penetration that justifies the extra encoding and storage costs. One study, an homage to HEVC titled Spotlight on HEVC: The codec of choice for the video streaming industry, sponsored by InterDigital, put that number at 30%.

Here’s the source of this estimate. “The migration to HEVC is largely determined by the primary streaming service providers. They regularly evaluate the population of devices in the field that have hardware or software video decoders available. Even discounting the potential to deliver 4K HDR content, most indicate that a device penetration of around 30% is the required trigger level for deployment of any codec, not just HEVC.”

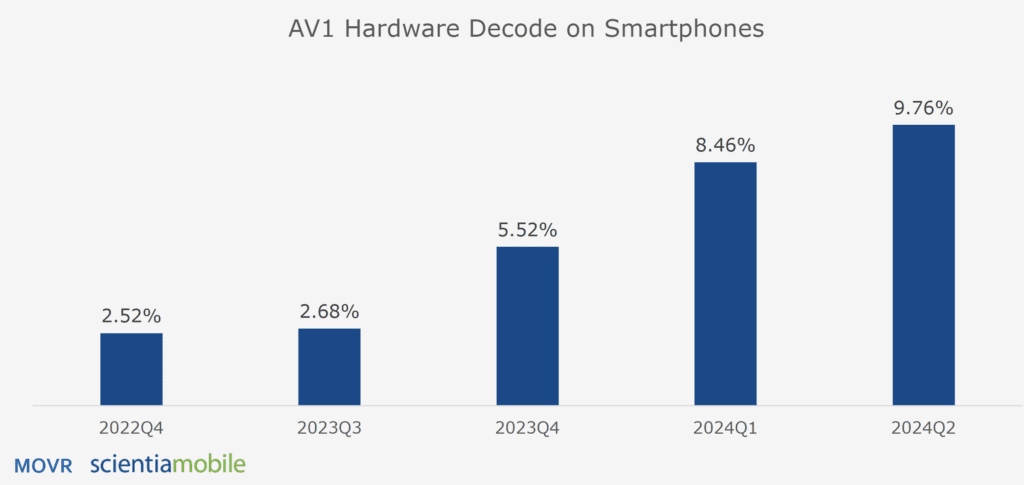

In other words, deploying a codec to a platform doesn’t make economic sense until the percentage of compatible devices is around 30%. Looking at the mobile sector, Scientiamobile has tracked AV1 hardware decode on smartphones for several years. As of Q2 2024, only 9.76% of smartphones have AV1 hardware decode (Figure 2). Unfortunately, we don’t have similar numbers for AV1 decode in smart TVs, though these devices began to appear in 2020.

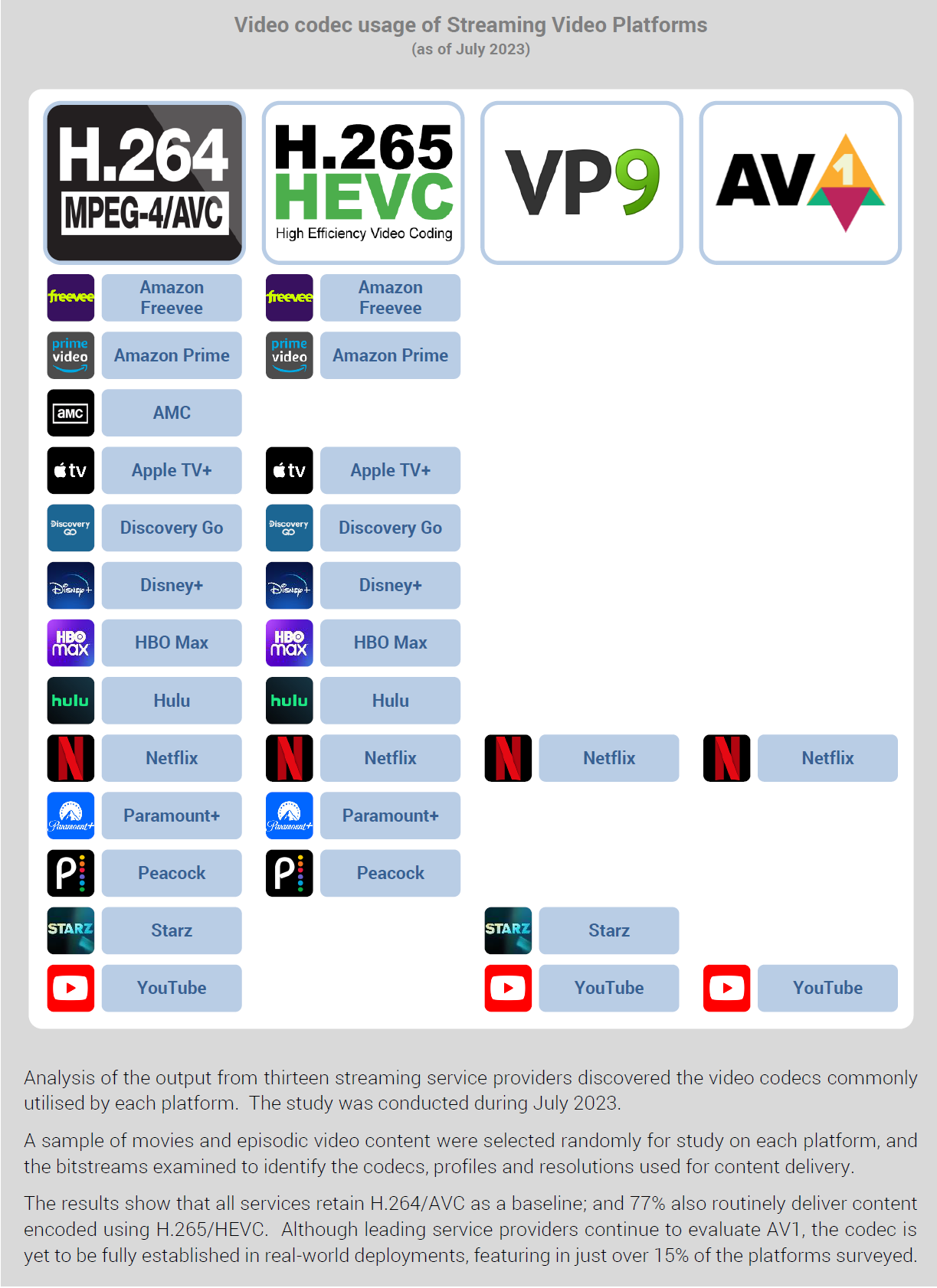

Perhaps not surprisingly, as of July 2023, the InterDigital-sponsored white paper indicated that AV1 adoption was limited to AOMedia members Netflix and YouTube among major publishers (Figure 3). Substantiating this to some degree, the Telestream Global Media Format Report for 2023, which reported on 2022 encoding data, pegged AV1 production for Telestream (formerly encoding.com) at 3%. Obviously, this doesn’t include Netflix, Meta, YouTube, and other publishers with their own encoding farms, but 3% is still a tiny number.

Interestingly, in a recent article, Netflix’s Ann Aaron stated, “We’ve encoded about two-thirds of our catalog in AV1,” Aaron said. The percentage of streaming hours transmitted in AV1 is “in the double digits.” As Thierry Fautier remarked in his LinkedIn post on the Aaron interview, this shows “there is still a reach problem on the device side.”

Fautier also noted, “On the HDR side, nothing is said.” This means we still don’t know if Netflix is streaming AV1 in HDR, which it clearly wasn’t when it began distributing video to Smart TVs. (See here – “Another exciting direction we are exploring is AV1 with HDR. Again, the teams at Netflix are committed to delivering the best picture quality possible to our members. Stay tuned!”).

Not to make too big a point of it, but premium services are all about QoE, not bandwidth savings. No matter how much bandwidth it saved, it seems unlikely that any publisher would substitute AV1-encoded SDR for HEVC-encoded HDR. The standards are certainly in place for AV1 and HDR (see HDR10+ here and Dolby Vision here), but it’s unclear who’s delivering AV1 in HDR (other than YouTube with its proprietary version) and how proven playback is.

A Realistic Deployment Timeline

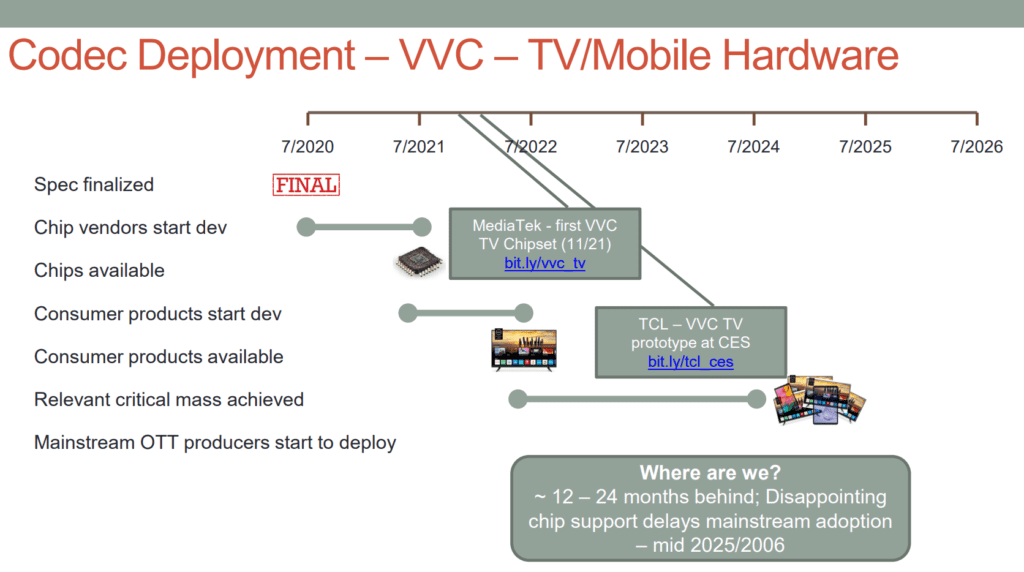

All these observations led me to create my own adaption timeline, shown in Figure 4. This incorporates AOM Media’s “one year for silicon and two years for consumer devices” assumption, which has proven aggressive, and adds a 2-3 year window for consumer adoption to achieve the 30% threshold for major publishers to address.

Note that I created Figure 4 in 2023, and little progress has been made in the past 14 months. Specifically, there is still only a sprinkling of VVC-enabled TV sets and no smartphones or tablets. So, add a year or two to the 2005/2006 prediction for mainstream adoption.

The important takeaway from this image is the 2-to 3-year period to achieve sufficient market penetration for independent publishers. It’s not the launch of compatible playback devices; it’s the accumulation of a viable target market.

Whither VVC

All this takes us to a recent MC-IF panel that explored “the evolving landscape of VVC” and concluded that “Versatile Video Coding (VVC) promises to play a pivotal role in driving advancements in video compression technology, with organizations across the globe recognizing its potential to significantly advance broadcasting, streaming and digital communications services by enhancing user experiences and reshaping the future of digital content delivery.” Notable VVC adoptions included VVC in the ATSC standard and Brazil’s TV 3.0 initiative.

These are promising design wins, but the obvious point is that future technology adoptions don’t accelerate the timeline shown in Figure 4. New standards simply kickoff the hardware adoption cycle, which, unfortunately takes 3-5 years until the new market becomes addressable.

For smart TVs, there are no alternatives; it’s hardware or nothing. For mobile, this raises the inevitable question: What about software playback? Well, we have a picture for that, as well.

The Myth of Software Decoding

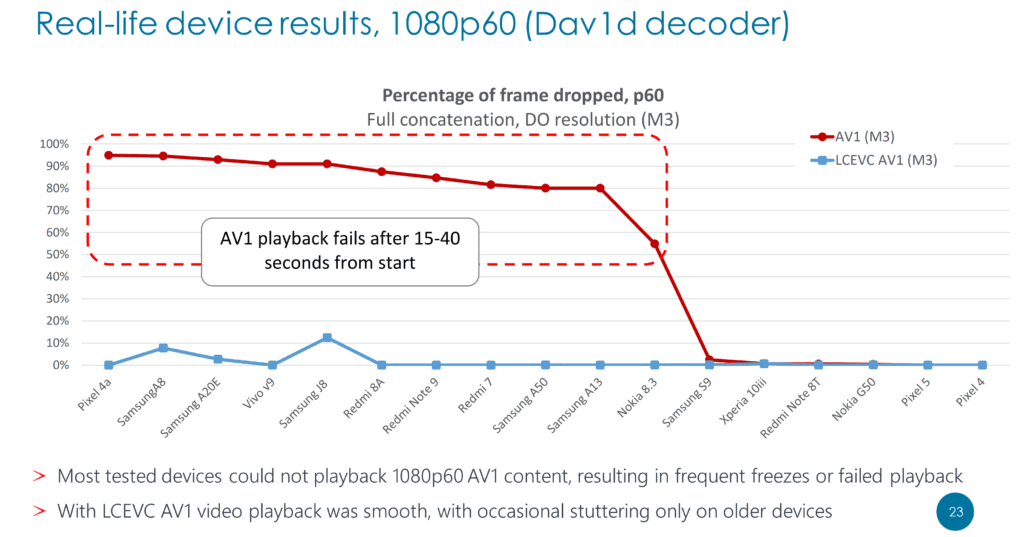

As mobile phones become more powerful, they can potentially play back codecs like AV1 and VVC without dedicated hardware decoding. However, at least with older devices, this will often reduce playback smoothness and battery life. The point of Figure 5, from a presentation entitled, Enhancing SVT-AV1 with LCEVC to improve quality-cycles trade-offs and enhance sustainability of VOD transcoding, is that even with the much-heralded Dav1d decoder, many devices dropped frames during playback.

Certainly, V-NOVA is pushing for LCEVC adoption in this report, which might cause you to question its results. But as you may recall, in April 2024, Google took a lot of heat for defaulting to AV1 with software decode on Android phones, which caused “vastly increased battery usage and dropped frames when viewing YouTube content in the app.”

I honestly don’t know if this was a mountain-out-of-a-molehill Internet event or a real conern. But I do know that companies proposing or implementing software playback on mobile are never independent publishers. With AV1, it was AOMedia members, Netflix, Meta, and Google, while with VVC, it was large VVC patent owners Kwai and ByteDance. Anytime you think independent publishers will take a flyer and get aggressive with a new codec deployment, take another look at Figure 3.

The Headwinds of Content Royalties

The last image reminds us that codec usage by streaming publishers now comes with a strong potential for content royalties. The image reflects Netflix’s loss to Broadcom in Germany, but other sources of content royalties abound. The Avanci Video Pool is targeting “Internet video streaming companies that are providing internet video streaming services to its users using any of the five standards—H.265 (HEVC), H.266 (VVC), VP9, AV1, and MPEG-DASH.”

Nokia is suing Amazon and HP for content royalties and recently reported “a patent license agreement with a direct-to-consumer video streaming platform. Under the terms of the multi-year agreement, the other party will make royalty payments to Nokia for the use of our patented multimedia technology in their video streaming service.”

Before 2023, it was safe to assume that a publisher’s codec adoption decision involved little potential for royalties. Now, the inverse is true; any streaming publisher using any codec may be liable for content royalties. Given the multi-source, scattershot nature of these claims, figuring out the potential costs and factoring those into the codec adoption decision will almost certainly delay some new codec deployments.

Summary

If you’re a streaming publisher considering a new codec, the clock doesn’t start clicking until there are actual consumer units shipping, and the bell doesn’t ring until the addressable market approaches 30%. AV1 is probably getting there for smart TVs, though the HDR picture is still a bit cloudy, as many AV1-compatible TV sets shipped before relevant standards were set. As the Scientiamobile data reveals, mobile penetration of AV1 hardware playback is far from 30%.

VVC is barely out of the starting gate for smart TVs and has failed to launch in mobile. While there may be some closed-loop, greenfield IPTV-like applications that launch sooner, for general-purpose OTT publishers, it’s a 3-4 year slog to get to 30% in either market. That’s after multiple consumer level products start shipping.

Regarding mobile, codec stakeholders will always advocate for software playback, but historically, independent publishers are much more conservative. Perhaps that will change with VVC, but Google’s switching to AV1 software playback on Android devices met with the noted resistance.

Finally, going forward, the economics of codec adaption will have to incorporate the potential for content royalties from parties and in amounts known and unknown. As we all know, nothing stifles technology adoption like uncertainty.

As I said at the top, I’m a codec advocate and wish my predictions were more positive. But whenever I consider these issues with these six pictures in mind, I get the same answers.

Streaming Learning Center Where Streaming Professionals Learn to Excel

Streaming Learning Center Where Streaming Professionals Learn to Excel