A recent report published by Unisphere Research and Streaming Media magazine, and sponsored by Beamr, reveals some interesting data on HEVC adoption. Entitled Real-World HEVC Insights: Adoption, Implications, and Workflows, the report is available for free download on StreamingMedia.com (registration required) and is authored by my colleague Tim Siglin, a Streaming Media contributing editor and founding executive director of the not-for-profit Help Me Stream Corporation.

Briefly, the survey garnered 406 quality responses, with 66% of respondents hailing from North America, another 20% from Europe, 6% from Asia-Pacific, and 4% from South America. Of these respondents, 31% were in engineering, 16% in operations, 25% in executive management, and 9% in project management.

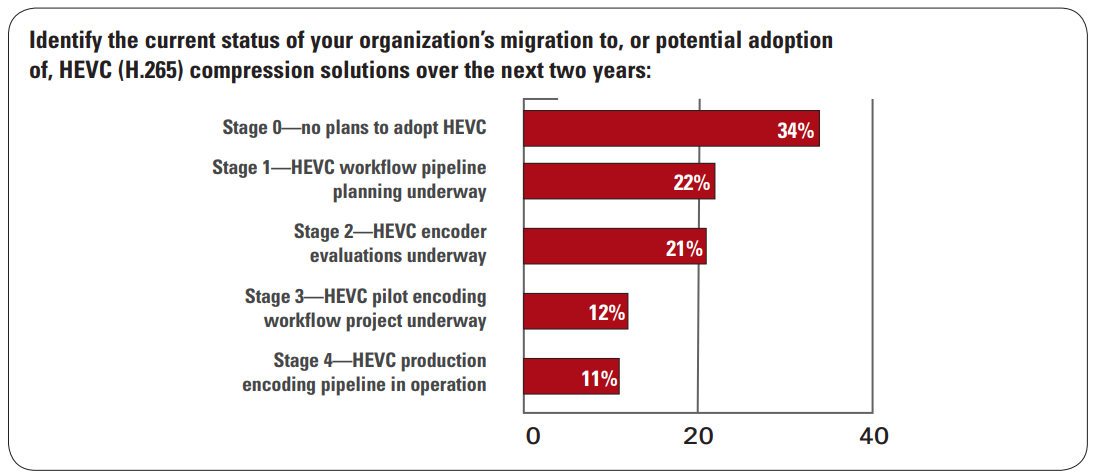

After identifying the demographics, the report details where the respondents were in their migration to HEVC. As you can see in Table 1, 66% were either in the planning stage or beyond, with 11% in actual production, and 34% not planning to adopt HEVC. Interestingly, while 79% of respondents planned to use HEVC for 4K videos, 77% planned to use HEVC for 1080p videos, though this number fell to 37% for 720p videos. Significantly, 56% of respondents planned to integrate HEVC encoding into their existing AVC encoding pipeline, which should simplify deployments.

Table 1. Status of migration to HEVC.

The survey next asked respondents which paid OTT services they actually used at home. Not surprisingly, Netflix (74%), Amazon Prime (60%), and Apple iTunes (40%) dominated, with YouTube TV at 27%, Hulu at 22%, and HBO Now at 21%.

Then, the survey delved into target devices and encoding practices. Interestingly, 61% of respondents encoded on premise, 27% in a public cloud, and 21% in a private cloud, with 29% using a hybrid on-premise/cloud approach. Regarding codecs, 58% planned to “invest in” HEVC in the next 12 months, with 52% indicating similar plans for H.264, 21% for AV1, and 14% for VP9.

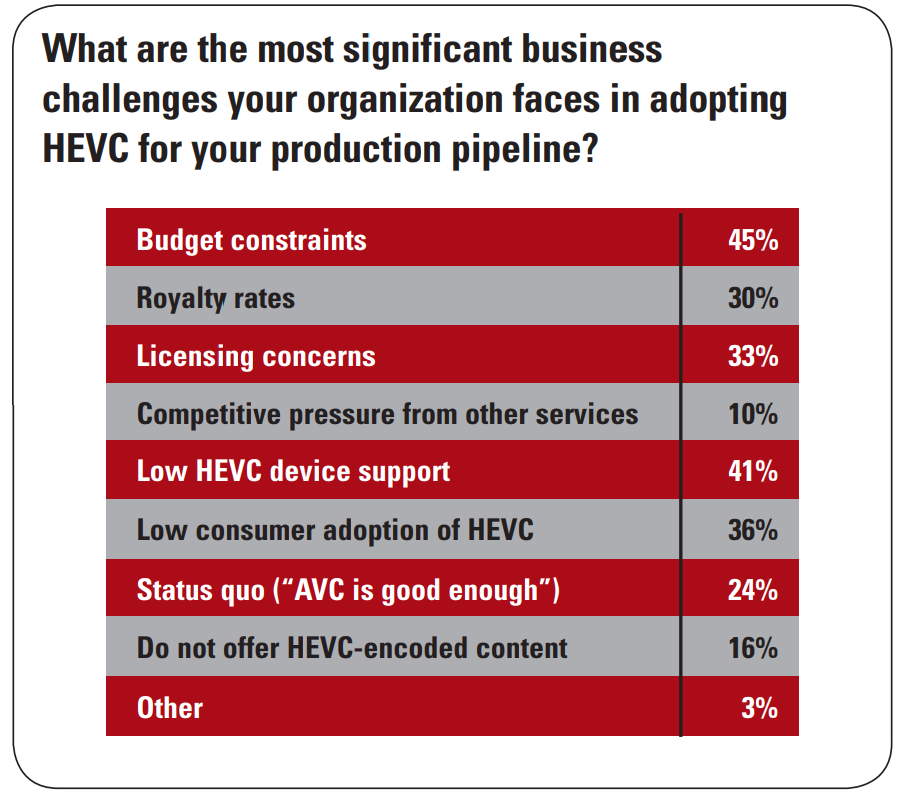

Figure 2 ranked the challenges that respondents faced in adopting HEVC, with budget being the primary factor, followed by low HEVC device support, royalty rate, and licensing concerns. The report concludes with a look at production workflows, where a surprising 35% of respondents used encoding appliances, 36% used FFmpeg, and 22% used a commercial workflow management system.

Figure 2. Challenges associated with HEVC adoption.

In the conclusion, Siglin notes that while licensing uncertainties have slowed HEVC’s adoption, some of this was resolved when HEVC Advance eliminated license fees on non-physical media. He finishes by stating, “AV1 is not yet locked out of the market, but it is clear HEVC continues to gain traction. With the added benefit of HEVC easily fitting into some existing AVC workflows, the pace of HEVC adoption should steadily continue throughout 2018.”

This strikes me as a non-sequitur as if codec adoption is a zero-sum game where one codec will achieve 100% and the other will be locked out. HEVC is entrenched in Smart TVs and OTT devices and will remain so, but seems to have made little progress in iOS, tvOS, and MacOS via HLS. HEVC is nowhere in computer browsers, and with Google, Microsoft, Mozilla, and Apple in the Alliance for Open Media, its prospects look bleak. Ditto on Android, where HEVC software playback peaks at 960×540@30 fps, compared to 4K for iOS and AppleTV.

While AV1 won’t blossom on devices and smart TVs until 2020, Netflix and YouTube should start distributing streams to computers in mid to late 2018. Legal issues notwithstanding, it’s unlikely that either AV1 or HEVC will be “locked out” of any market for at least the next five years. This nit aside, the survey and report is a useful source of information for anyone who is considering adopting HEVC in the near term.

Streaming Learning Center Where Streaming Professionals Learn to Excel

Streaming Learning Center Where Streaming Professionals Learn to Excel

Thanks for the plug for the article, Jan, and for mentioning the not-for-profit Help Me Stream.

The term “locked out” may have been a poor choice of words, and I appreciate your pointing out that it’s a non-binary equation where each codec will have *some* tracking.

But I’m basing the “locked out” comment on the historical context that you and I both remember from the H.264 (AVC) licensing days. For all intents and purposes, VP7/8 was the sacrificial lamb that pushed MPEG-LA to reform H.264 licensing. Given recent movement in the H.265 (HEVC) licensing bodies, I suspect that we’re headed the same direction: AV1 has been the impetus to get half of the licensing issues for HEVC addressed, and if the rest of the licensing issues are addressed, I suspect AV1 will find traction quite difficult.

I may be wrong, but maybe only by a few % on one side or the other of 10% for AV1 overall adoption in the next two years…

So many differences.

1. MPEG LA is a rational organization and was solely in charge of the decision. In particular, the Velos pool, which stubbornly still won’t publish rates or confirm no royalty on content, seem like their intent is to stifle HEVC’s potential. There’s a Producer’s analogy in there (a play so bad it had to fail but it succeeded) but HEVC isn’t succeeding.

2. VP8 was Google-only with a poorly documented codec launched after H.264 was everywhere (Flash = 99%). AV1 is the Alliance, and they are believers, and five years after launch, only 11% of your respondents are encoding HEVC.

3. The HEVC IP owners have shot themselves in the foot so many times even their chairman thinks the business model is broken.

4. H.264 (at the time) was $5 million/year; HEVC is north of $65 million and that doesn’t count Velos or Nokia.

So, I don’t get the sense that AOM is a play to convince HEVC IP owners to get reasonable; I think it’s a real shot and litigation is the only thing that could slow it down.

I think the Alliance believes they are a play just like On2’s VP7 /Google’s VP8 had its believers. But all it took was a clarification of the licensing by MPEG-LA to pull the rug out from under VP7/8…. maybe the patent holders haven’t learned their lesson (took them long enough to issue first clarification) but if they get their act together soon, I fear we’re in for a long reign of HEVC.

Regarding the 11% number, that’s in line with H.264 (actually slightly better) uptake numbers. I used H.264 for two years before streaming even started (it was a derivative of H.263 for those of us in videoconferencing) and it wasn’t until two years after that the JVT even existed.

By contrast, HEIC has been firmly entrenched in iOS at a very significant consumer adoption rate,and HEVC isn’t far behind. So this seems much more a pull play rather than a push play, just like laptops and gaming PCs drove forward their business laggard counterparts.

Then again I could be completely wrong 🙂

It’s not that HEVC adoption is slow compared to H.264. it’s that H.264 dominated the entire streaming market before VP8 launched. Adobe added H.264 to Flash in August 2007 for $5million/year. About 99% of browsers could play H.264 in 6 months. iDevices all played h.264.

Google open-sourced VP8 3 years later in August 2010 to a market saturated with H.264. There was no need for VP8 and it never caught on. Ditto for VP9, in large part because Apple and MS (IE market share used to be huge) never picked it up. Of course, Google never stopped using VP8 and later VP9 because YouTube needed its own codec (and still does).

HEVC has made zero progress in browsers, is subpar in software on Android (as is Baseline only H.264), and hasn’t yet caught on for HLS, though I can’t see why it won’t. Depending upon the decode requirements, AV1 could make serious inroads in all browsers by year end. It’s going to be on every device made by 2020 (who doesn’t want to play video from Netflix, YouTube, Amazon, Hulu, Facebook?).

I was one of the commentators who cited VP8 as the reason MPEG LA dropped potential for royalty on H.264. To me, this situation is totally different, but then again, I could be completely wrong.