The Bitmovin Video Developer Report, now in its 6th edition, is one of the most far-reaching and useful documents available to streaming professionals (now with no registration required). It’s a report that I happily download each December and generally refer to frequently during the next twelve months.

Like the proverbial elephant, what you find important in the report depends upon your interests. I typically zero in on video codec usage, encoding practices, and the most important problems and opportunities facing streaming developers. As discussed below, this year’s edition has some surprises, like the fact that more respondents are currently working with H.266/VVC than AV1.

Beyond this, the report also tracks details on development frameworks, content distribution, monetization practices, DRM, video analytics, and many other topics. This makes it extraordinarily valuable to anyone needing a finger on the pulse of streaming industry practices.

Let’s start with some details about how Bitmovin compiles the data and then jump to what I found most interesting.

Contents

Gathering the Data

Bitmovin collected the data between June and September 2022. A total of 424 respondents from over 80 countries answered the survey. Geographically, EMEA led the charge with 43%, followed by North America (34%), APAC (14%), and Latin America (8%). Regarding job function, 34% of respondents were manager/CEO/VP level, 23% developer/engineer, 14% technical manager, 10% product manager, 9% architect/consultant, 7% in R&D, and 3% in sales and marketing.

A quarter of respondents worked in OTT streaming services, 21% in online video platforms, 15% for broadcasters, 12% for integrators, 7% for publishers, 6% for telcos, 5% for social media sites, with 10% other. In terms of company size, 35% worked in companies with 300+ employees, 17% 101-300, 19% 51 – 100, and 29% 1 – 50. In other words, a very useful cross-section of geography, industry, job function, and company size.

To be clear, the results are not actual data from Bitmovin’s cloud encoding facility, which would be useful in its own right. Rather, the respondents answered questions about their current practices and future plans in each of the listed topics.

Current and Planned Codec Usage

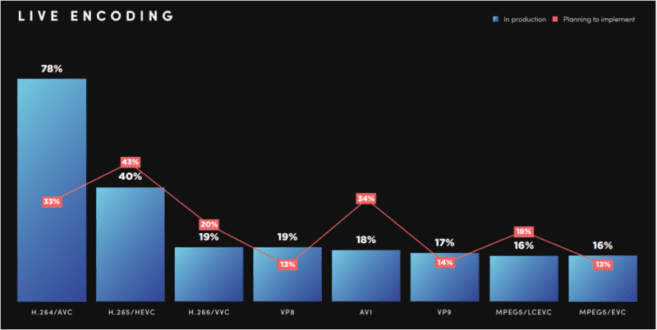

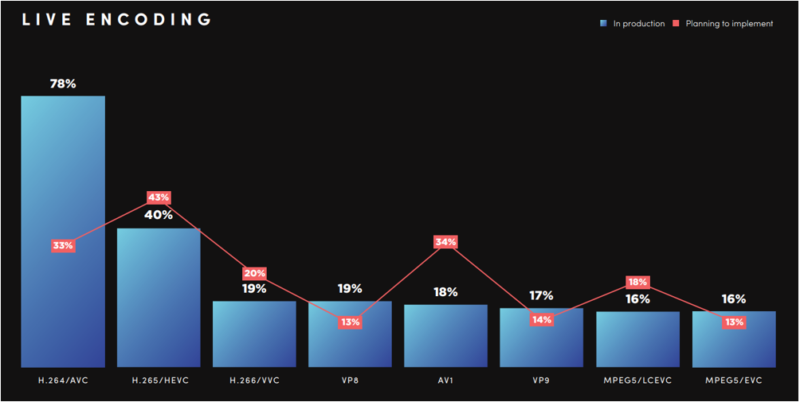

It’s always a surprise to see H.264 at less than 100%, but there’s 78% clear as day. Even given the breadth of industries that responded to the survey, it’s tough to imagine any publisher not supporting H.264.

Figure 1. Answers to the question, “Which streaming formats are you using in production for distribution and which ones are you planning to introduce within the next year?”

HEVC was next at 40%, with AV1 in fifth at 18%, bracketed by VP8 (19%) and VP9 (17%), presumably more for WebRTC than OTT. These are the codecs most likely to be used to actually publish video in 2022. Other codecs presumably implemented by infrascture providers were H.266/VVC a suprising third at 19%, with LCEVC and EVC both at 16%.

Looking ahead, HEVC looks to be most likely to succeed in 2023 with 43% of respondents planning to implement, with AV1 next at 34%, H.264/AVC at 33%, and VVC at 20%. Given that CanIUse lists AV1 support at 73% while VVC isn’t even listed, you’d have to assume that actual AV1 deployments in the near term will dwarf H.266/VVC, but you can’t ignore the interest this standard based codec is receiving from the industry. VOD encoding tracks these results fairly closely for both current and planned usage.

Video Quality Related Findings

Quality is a constant concern for video professionals and quality-related data appeared in several questions. In terms of challenges faced by respondents, “finding the root case of quality issues” ranked fifth with 23%, while “quality of experience” ranked ninth, with 19%.

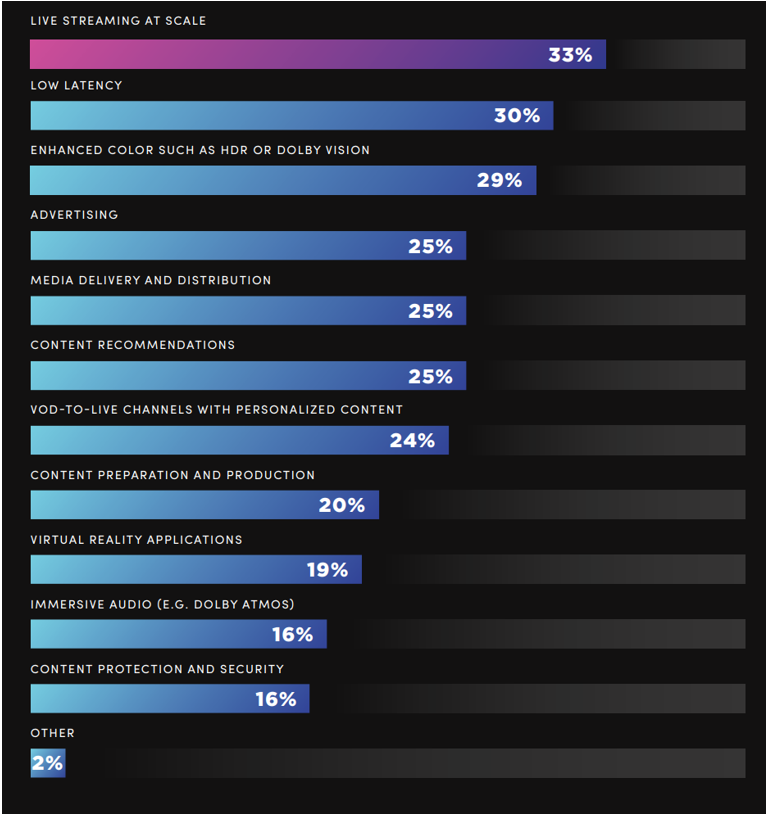

Interestingly, in response to the question, “For which of the following video use cases do you expect to use machine learning (ML) or artificial intelligence (AI) to improve the video experience for your viewers,” 33% cited “video quality optimization,” which ranked third, while 30% cited “quality of experience (QoE),” which ranked fourth.

With so many respondents looking for futuristic means to improve quality, it was ironic that so many ignored content-aware encoding (CAE), a proven method of improving both quality and quality of experience. Specifically, only 33% percent of respondents were currently using CAQ, with 35% planning to implement CAE within the next 12 months. If you’re not in either of these camps, consider yourself scolded.

Live Encoding Practices

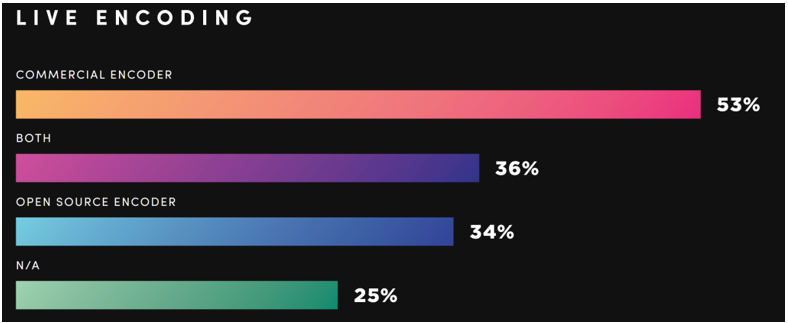

Lastly, I focused on live encoding practices, finding that 53% of respondents used commercial encoders, which presumably include both hardware and software. In comparison, 34% encode via open source, which is all software. What’s interesting is how poorly this group dovetails with both the most significant challenge faced by respondents and the largest opportunity for innovation perceived by respondents.

Specifically, controlling cost was the most significant challenge in the report, selected by 33% of respondents. On a cost per stream basis, considering both CAPEX and OPEX, software-encoding is by far more expensive than encoding with hardware, particularly ASICs.

The most significant opportunity for innovation reported by respondents was live streaming at scale, again at 33%. In this regard, the same lack of throughput that makes CPU-driven open-source encoding the most expensive solution makes it the least scalable. Simply stated, publishers currently encoding with CPU-driven open-source codecs can help address both their biggest challenge and their most significant opportunity by switching to ASIC-based transcoding.

Curious? Download our white paper, How to Slash CAPEX, OPEX, and Carbon Emissions Using the NETINT T408 Video Transcoder here. Or, compute how long it will take to recoup your investment in ASIC-based encoding through reduced power costs via calculators available here.

And don’t forget to download the Bitmovin Video Developer Report, here.

Streaming Learning Center Where Streaming Professionals Learn to Excel

Streaming Learning Center Where Streaming Professionals Learn to Excel